Bucket Savings End-to-End Application

Gamifying the money saving process

Academic Project

Sector

Lifestyle, Finance, Design

Role

Solo Designer

Tools Used

Figma, OptimalSort

Project Timeline

4 Weeks

Background

-

App to help people save money

Gamifies the money saving process to make it fun

Encourage users to focus on each micro-goal rather than getting overwhelmed at how much they need to save for their end-goal

-

Saving money is often seen as a chore

You’d rather spend it, but you save because you know you have to

Saving for a big goal can feel daunting

-

What if we could make saving more fun?

It could give you the satisfaction of spending money on yourself now, when all you’re really doing is saving money now to spend on yourself in the future

In doing so, could make saving feel manageable

Business Goal

Increase user base

User Goal

Save money

Competitive Analysis

Originally I was thinking of creating your run-of-the-mill budgeting app, so my competitive research was done on similar apps and budgeting methods.

It was interesting to find that people who preferred using apps, liked it for the automation aspect. On the other hand, people who preferred using Excel or Google spreadsheets liked it for the precision.

Interviews

Demographic

4 Females, 1 Male

Ages 22-29

Some of the interview questions

What motivates you to save money?

How do you regulate yourself when it comes to buying things?

When’s the last time you felt pressured to spend money? Can you tell me more about it?

Findings

Motivations:

2/5 Participants emphasized how much they enjoy seeing their balance rise

4/5 Participants mentioned having a specific goal they work towards (whether it be a house, retirement, or even saving up for rent)

Behaviour:

3/5 participants immediately put money into savings whenever they get a paycheck and treat it like it’s no longer theirs to use

Game References

“I try to make a game with myself where I try to keep my expenses as low as possible.”

— Participant 5

“It’s kind of like a progress bar of spending, if I already spent a lot of money then maybe I’ll tighten up my budgets but if I haven’t spent much money I’m fine with blowing a bunch at once.”

— Participant 2

Creating a Game/Challenges to Encourage Saving

It was at this point, that I began exploring the idea of gamifying the process to serve as an incentive. I played around with the following ideas:

Tend to spend more money in social situations > “have a stay at home week”

3/5 Actively try to spend less than what they have leftover in spending money > “spend under your budget this week”

“Keep your expenses as low as possible this month”

Names for each challenge, and it’ll keep a record of your best result

Users will continue to try to beat their previous results

Kind of tricks them into motivating themselves because they’re in competition with themself

My mentor suggested that the incentives (rewards) be directly related to the users saving goal. After hours of brainstorming exactly how the app would work, I came up with Bucket Savings. It’s based on the bucket savings method, which involves creating separate savings accounts according to your goals, referred to as “buckets”. You then allocate a portion of money to each.

Feature Roadmap

Keeping user needs at the forefront, the feature roadmap was created from the perspective of our persona.

Information Architecture

Objectives:

Learn what buckets to include.

What to name the buckets.

How best to organize them.

Card sorting was conducted with potential users in order to achieve these objectives.

Conclusions:

Buckets will be split into short-term and long-term goals

They won’t be broken up into subcategories, to reduce the number of clicks required to set up your first bucket

One interview participant dropped an app during onboarding because it was taking too long

Interaction Design

To start building the app, I created a task flow and user flow to figure out what frames to create.

Low-Fidelity Wireframes

With the user flow in mind, I built out the wireframes.

UI Design

I created a bucket logo to reflect the savings concept. The colors were chosen to convey a sense of calmness and security. Bucket Savings shouldn’t make users feel anxious; they should feel as if they can move at their own pace.

Usability Testing & Iterations

Test Objectives:

Find out if users are able to set up their bucket.

Determine if users understand how the checkpoints work.

Find out if users know how to add additional savings into a bucket.

Tasks:

Create your account and connect your bank account.

Create your first bucket.

Find the details of your first quest and mark what you’re interested in.

Find the details of your first quest and mark what you’re interested in.

Want to test out the prototype? You can find it here.

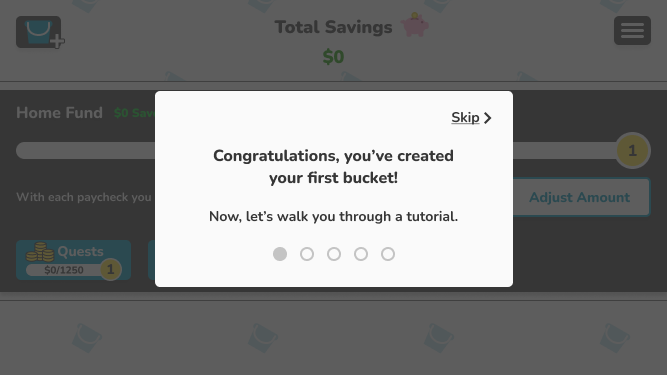

“The quests were intuitive to me because I play a lot of games, but for someone else who doesn’t, it might not be as intuitive for them. But a simple tutorial would fix that.”

— Participant 1

“It did catch my attention, but because things are floating outside of the other buttons, it made me question whether the red notification was always there.”

— Participant 2

Results:

2/3 Participants completed all tasks with no issues

Through usability testing I learned how much instruction was lacking

I was so focused on keeping the setup as brief as possible to prevent users from dropping the app during onboarding, just as an interview participant had

But I realized that all games require instruction, so this app would be no different

It was nice to learn that all participants actually welcomed a tutorial

I made the subsequent iterations according to feedback I received from usability testing; the most important iteration being the tutorial. You can view the full tutorial here.

Conclusions

Through interviews, I discovered the interesting idea of turning money-saving into a game to drive one's goals forward. Although I’m happy with what I have, I’m aware that the concept is nowhere close to being fully fleshed out.

As a next step, it would be ideal to have a website where users can learn more about the security of the product. This was a very important value that was brought up during interviews. Users don’t feel comfortable giving their credit card information to a business unless they know it’s credible.

My key takeaway from this case study is that I need to take a step back from the project at hand to look at it with fresh eyes. I know I tend to get tunnel vision so, in the future, I’d like to imagine looking at the product as a new user who knows nothing about it. This way I can better see where the product may be lacking.